21 Entry-level Finance Degree Jobs You Can Apply For

Team Prosple

The world of finance is full of exciting opportunities. However, the real challenge is finding the perfect fit among all the finance degree jobs. Maybe you already have your dream finance job or feel overwhelmed by all the options. Either way, this is the perfect place to start.

We have compiled a list of 21 exciting entry-level jobs you can apply for with a degree in finance in your hand. We will walk you through the day-to-day responsibilities of each role and give you an idea of how much you can expect to earn.

21 finance degree jobs you can pursue right out of university

Each role we will discuss comes with its own tasks and responsibilities. So, take your time and read through the descriptions carefully. Match the details of each job with your skills and interests to find the perfect fit.

1. Credit analyst

As a credit analyst, you will assess the creditworthiness of borrowers – individuals or businesses. You will analyse financial statements, credit history, and other data to determine how likely they are to repay a loan.

Your recommendation helps banks and other lenders make informed decisions. Essentially, you uncover potential risks to protect lenders from bad debt.

Average annual salary

- $86,000

In-demand industries/sectors

- Fintech

- Banking

- Insurance

- Non-bank lending institutions

2. Junior auditor

This finance job is perfect if you have a keen eye for detail. As a junior auditor, you will assist senior auditors in examining a company's financial statements for accuracy. You will analyse financial records to identify any potential risks or errors.

Occasionally, you might also be testing internal controls to prevent fraud. In this role, you look for financial discrepancies and objectively assess a company's financial health.

Average annual salary

- $53,626

In-demand industries/sectors

- Accounting firms

- Public companies

- Regulatory bodies

- Large corporations

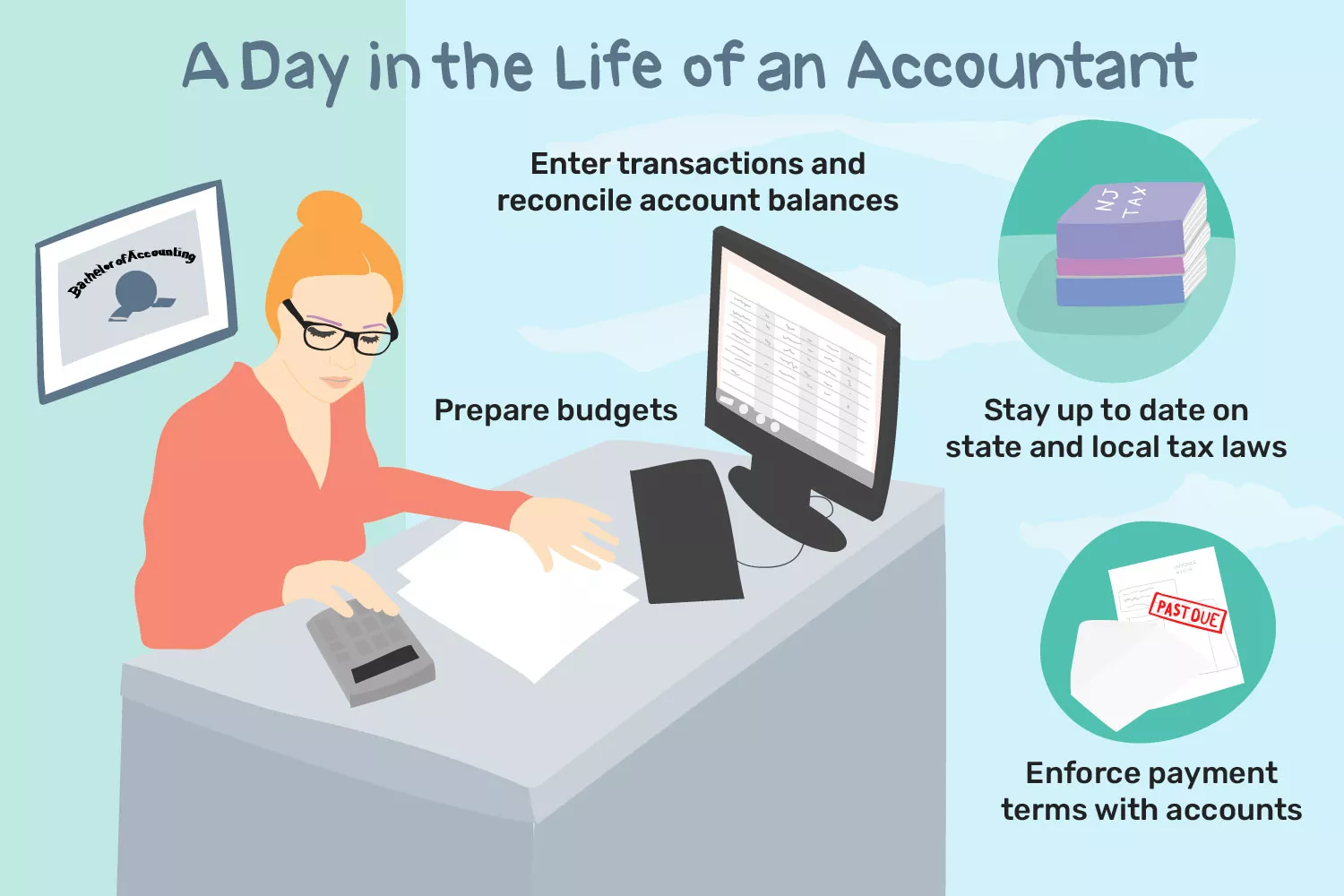

3. Accountant

Accountants are the record keepers of any organisation. You will track financial transactions (income, expenses) and prepare financial statements. You will also help businesses stay compliant with financial regulations.

In this role, you will keep track of the money coming in and going out for a smooth-running business. You might also help with budgeting, payroll, and tax preparation.

Average annual salary

- $88,250

In-demand industries/sectors

- Government

- Public practice

- Accounting firms

- Management consulting

4. Tax associate

The world of tax can be complex, but tax associates keep things organised. You will work with experienced tax professionals to prepare tax returns for individuals or businesses. This includes gathering tax documents, calculating tax liabilities, and complying with tax regulations.

As a finance professional in this role, you will also research tax laws and ensure clients comply with regulations to minimise their tax burden.

Average annual salary

- $73,084

In-demand industries/sectors

- Accounting firms

- Tax consultancy firms

- Government tax offices

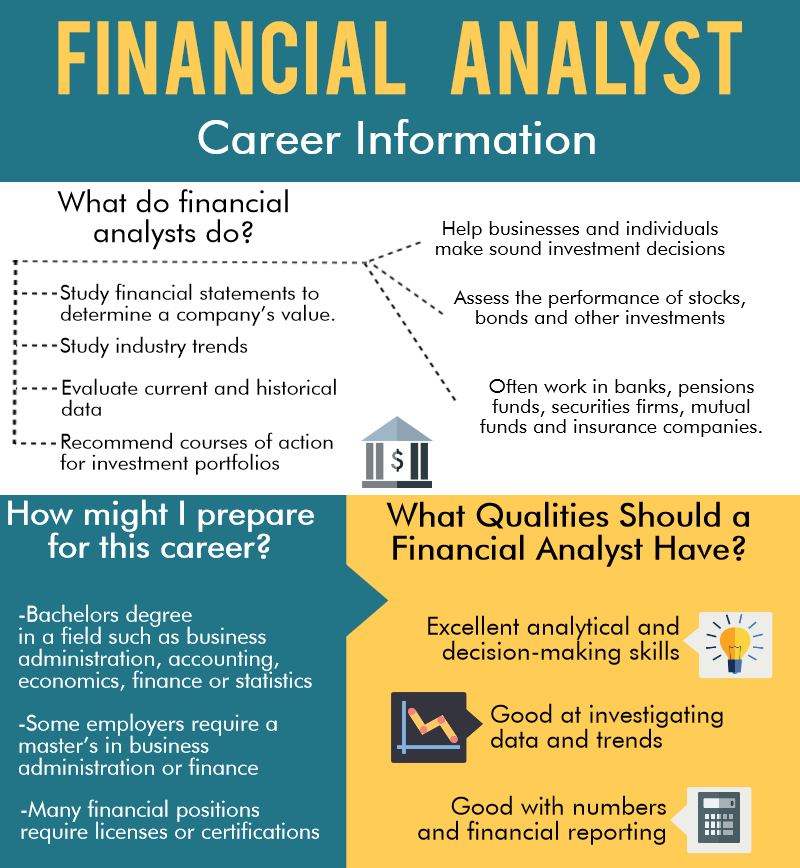

5. Financial analyst

Financial analysts are the information architects of a company's finances. In this role, you will gather, analyse, and interpret financial data to create reports and presentations. You combine the financial statements and market trends to paint a clear picture of a company's financial health.

You will also help with budgeting and forecasting and recommend improvements for better financial performance.

Average annual salary

In-demand industries/sectors

- Banking

- Insurance

- Consulting

- Management

- Manufacturing

6. Investment banking analyst

As an investment banking analyst, you will be in the thick of mergers, acquisitions, and initial public offerings (IPOs). You will support senior bankers or even the chief financial officer. Your role will include researching companies, creating financial models, and creating presentations for potential investors.

You will also be responsible for finding valuable financial insights to help companies make smart investment decisions.

You can join this field with just an undergraduate degree and a finance major, particularly at smaller firms or through internship experiences. But larger and more prestigious investment banks prefer candidates with a Master's degree in Business Administration.

Average annual salary

- $116,000

In-demand industries/sectors

- Private Equity

- Securities trading

- Corporate finance

- Investment banking

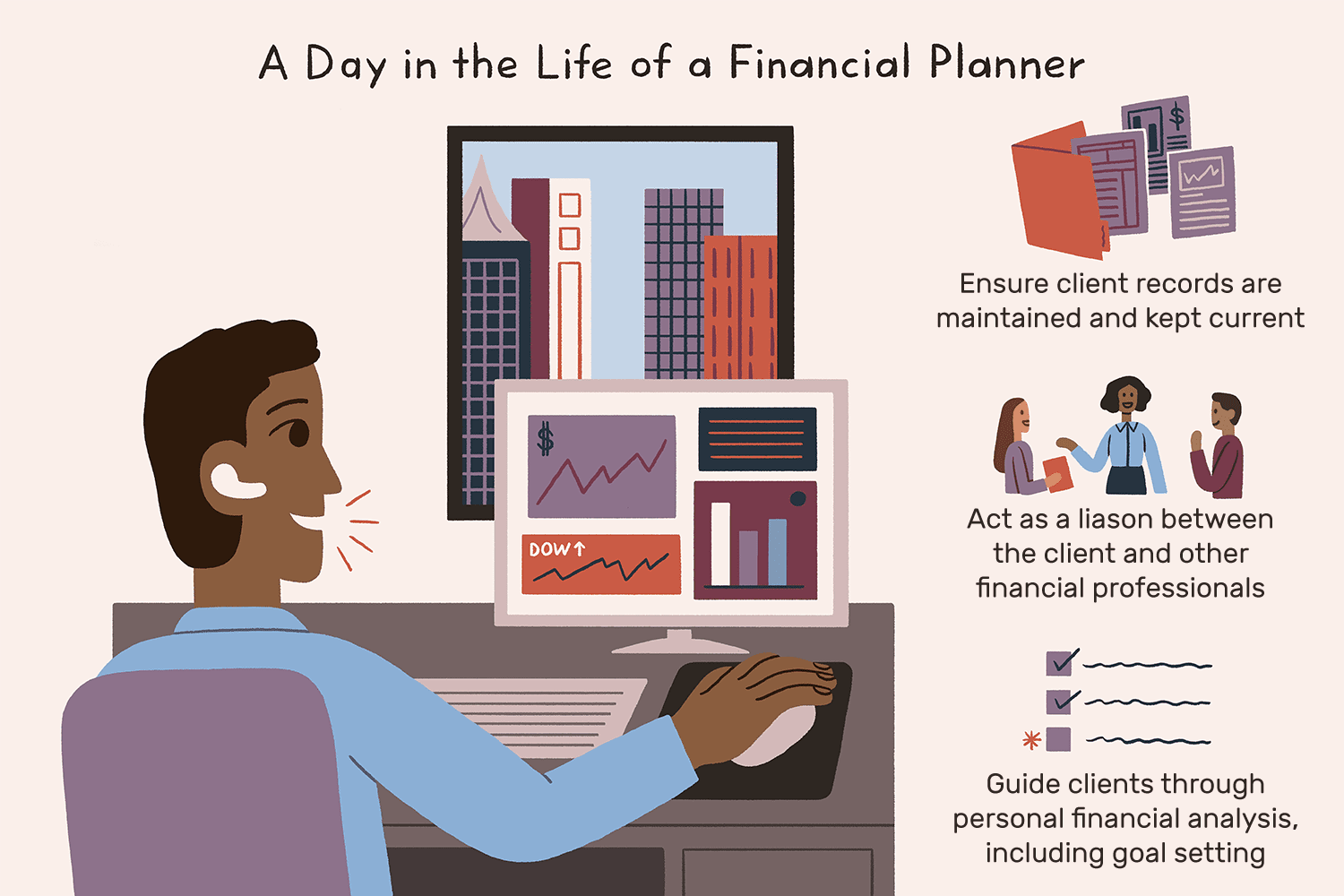

7. Financial planner

Financial planning is your perfect fit if you enjoy helping people reach their financial goals. You will work directly with clients and gather information about their financial situation, goals (eg. retirement planning or buying a house), and risk tolerance.

Based on this, you will create personalised financial plans recommending investments, budgeting strategies, and wealth management tactics. Simply put, you will be a financial coach who guides clients to a secure and prosperous future.

Average annual salary

- $135,000

In-demand industries/sectors

- Insurance companies

- Financial planning firms

- Wealth management firms

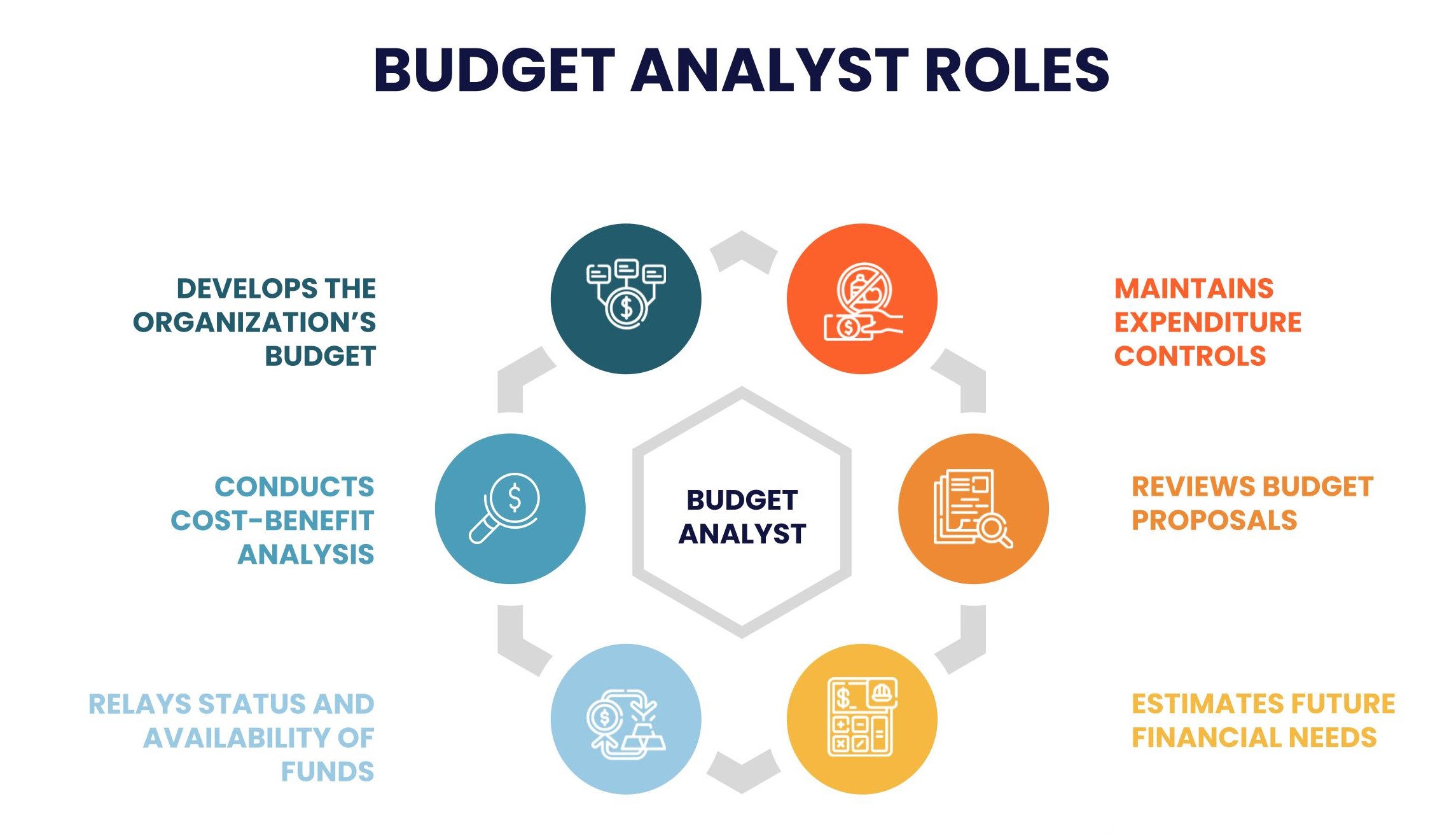

8. Budget analyst

Budget analysts are the brains behind a company’s financial planning. You will analyse financial data and create budgets according to company goals. You will work with different departments to understand their spending needs. Based on this data, you will forecast future expenses and identify areas for cost savings.

Average annual salary

- $90,010

In-demand industries/sectors

- Manufacturing

- Public companies

- Government agencies

- Non-profit organisations

9. Loan officer

If you have a people-first personality and enjoy helping others achieve their goals, become a loan officer. You will meet clients to assess their financial situation and loan needs. Based on the requirements, you will help individuals and businesses secure funding for homes, cars, or starting ventures.

You will guide them through the loan application process, analyse their creditworthiness, and recommend suitable loan options.

Average annual salary

- $76,000

In-demand industries/sectors

- Banking

- Credit unions

- Mortgage brokerage firms

10. Insurance underwriter

Insurance underwriters play a major role in the insurance industry. You will analyse applications for insurance policies and assess the risks involved, such as car accidents or property damage. Then, you will determine appropriate coverage and premiums.

As a risk assessor in the finance industry, you have to find the balance. You will protect insurance companies from financial losses while ensuring clients get the necessary coverage. Your decisions play a big role in protecting individuals and businesses from financial losses.

Average annual salary

In-demand industries/sectors

- Brokerage firms

- Insurance companies

- Financial services firms

- Reinsurance companies

11. Risk analyst

Risk analysts protect against financial surprises. You will identify, analyse, and assess risks companies or financial institutions face. You will uncover potential threats and recommend strategies to minimise their impact. Your work helps organisations make informed decisions and protect their financial well-being.

Average annual salary

- $86,150

In-demand industries/sectors

- Banking

- Insurance

- Consulting

- Investment management

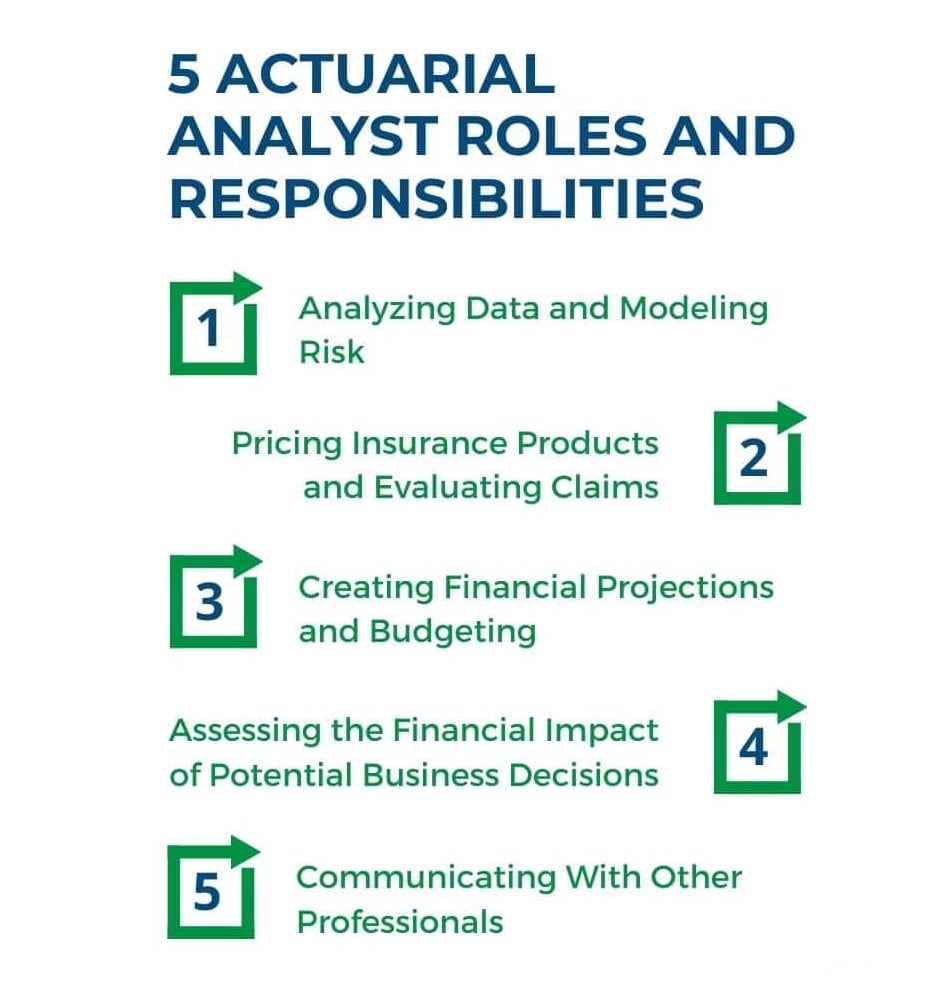

12. Actuarial analyst

Actuarial analysts use statistical analysis and financial modelling to assess risks in insurance and financial products. In this role, you will predict future events and their financial implications for companies.

You will help businesses set fair insurance prices and manage financial risks effectively. For this career path, you need strong mathematical skills and professional qualifications.

Average annual salary

- $85,750

In-demand industries/sectors

- Consulting firms

- Insurance companies

- Government agencies

13. Treasury analyst

You analyse financial markets to find the best investment options for the company's surplus funds. This means monitoring interest rates, currency exchange, and overall market trends.

You will also forecast the company's future cash needs and ensure enough money to cover expenses and investments. You will identify and analyse potential financial threats, like sudden market swings, and develop strategies to protect the company's money.

Average annual salary

- $97,750

In-demand industries/sectors

- Big banks

- Large corporations

- Insurance companies

14. Compliance analyst

In this role, your mission is to ensure the company follows financial regulations. You will research and interpret complex laws set by government agencies and monitor the company's financial activities to identify potential regulatory breaches.

If you find any red flags, you must report them to the appropriate authorities and work with the company to fix the issue.

Average annual salary

- $95,250

In-demand industries/sectors

- Healthcare

- Government agencies

- Banking and financial services

15. Portfolio analyst

Portfolio analysts gather data and analyse the performance of stocks, bonds, and real estate. You will use financial models and research tools to assess various investment risks and potential returns. This helps portfolio managers decide how to allocate funds and build investment portfolios for clients or the company.

Your responsibility will be to monitor market trends, news, and economic data to identify promising investment opportunities. You will also prepare reports and presentations about your findings for portfolio managers and other stakeholders.

Average annual salary

- $107,000

In-demand industries/sectors

- Investment banks

- Insurance companies

- Fund management companies

16. Personal financial advisor

Personal financial advisors provide personalised financial advice to individuals, couples, and families. You will meet clients to understand their financial situation, risk tolerance, and financial goals. Based on this information, you will recommend investment strategies, retirement planning solutions, and other financial products.

For this role, you must stay up-to-date on tax laws and investment products to provide your clients the best possible financial advice.

Average annual salary

In-demand industries/sectors

- Banks

- Independent practices

- Financial planning firms

17. Financial reporting analyst

Your job in this role will be to ensure the company's financial story is clear and accurate. Following strict accounting standards, you will prepare financial statements like balance sheets and income statements. This involves gathering financial data and analysing transactions to ensure everything adds up.

You will work closely with other departments, such as accounting and sales, to collect the information you need. Meeting deadlines is very important, as financial reports are used by investors, regulators, and management to make important decisions.

Average annual salary

- $85,587

In-demand industries/sectors

- Not-for-profits

- Public companies

- Private companies

- Government agencies

18. Procurement analyst

Your mission: save the company money. You will work with the sourcing team to analyse how the company spends money on goods and services. Your goal is to find the best deals from suppliers without compromising quality.

You will research and compare different suppliers and negotiate contracts to get the best prices and terms. You will also analyse spending patterns to identify areas for cost savings.

Average annual salary

- $89,375

In-demand industries/sectors

- Retail

- Government

- Manufacturing

- Wholesale and trading

19. Pricing analyst

In a pricing analyst role, you will analyse data to determine the right prices for a company's products or services. For this, you will consider factors like production costs, competitor pricing, and customer demand.

You will research market trends, analyse customer behaviour, and assess competitor pricing strategies. Based on this, you will develop pricing recommendations that maximise profit while staying competitive.

Average annual salary

- $85,000

In-demand industries/sectors

- Retail

- Telecommunications

- Professional services

20. Investor relations associate

Investor relations associates are the communication link between a company and its investors. In this role, you will work to maintain positive relationships with investors by keeping them informed about the company's performance and future plans.

You will monitor the company's financial news and announcements. You will also analyse investor sentiment and identify any concerns they have.

Average annual salary

- $105,368

In-demand industries/sectors

- Investment banks

- Financial services firms

- Asset management firms

- Publicly traded companies

21. Equity research analyst

As an equity research analyst, you will research companies and analyse their financial performance to identify potential investment opportunities. This involves looking into financial statements, industry trends, and company news.

You will write research reports with your findings and recommendations, either recommending stocks for buying or selling (buy or sell ratings). You will also present your research to investors and portfolio managers and answer their questions.

Average annual salary

- $200,000

In-demand industries/sectors

- Brokerage firms

- Investment Banks

- Independent research firms

- Fund management companies

Graduate ready: Use Prosple to transition smoothly to your career

Prosple is a job board for graduate programs, internships, and even volunteer opportunities—basically, it's your one-stop shop for finding that first real-world experience. We have hundreds of posts for finance professionals, so you should have a good chance of finding relevant opportunities.

Let’s see how Prosple can help you with your job hunt.

I. User-friendly dashboard with advanced search filters

Prosple offers a central hub where you can manage your job search. This dashboard lets you see all your saved jobs and applications and set up personalised alerts. With advanced filters, you can refine your search by specific criteria like location, industry, salary, and job type (full-time, internship).

It also saves you the hassle of applying through multiple channels and managing different accounts.

II. AI-Based matching algorithm

Prosple goes beyond simple keyword matching. Our AI considers your profile information, skills, and educational background to suggest jobs that fit you. This can help you discover hidden opportunities you would have missed with a traditional search.

III. Notifications & alerts

Prosple sends you notifications and alerts about new job postings that match your preferences. You can also set reminders for application deadlines or upcoming interview dates. This ensures you stay organised and on top of your job search.

IV. Verified job posts

Prosple strives to ensure the legitimacy of job postings. This can give you peace of mind knowing you are applying for real opportunities and avoid wasting time on scams.

V. List of top employers

Prosple compiles a list of top employers in Australia. This can be a great starting point for your research, especially if you are unsure which companies to target. These lists consider factors like employee satisfaction, career growth opportunities, or industry reputation.

VI. Career resources

Prosple offers resources beyond job listings. These include articles on resume writing, cover letter tips, interview preparation strategies, and even general career advice. Having these resources can greatly help you prepare for a finance career.

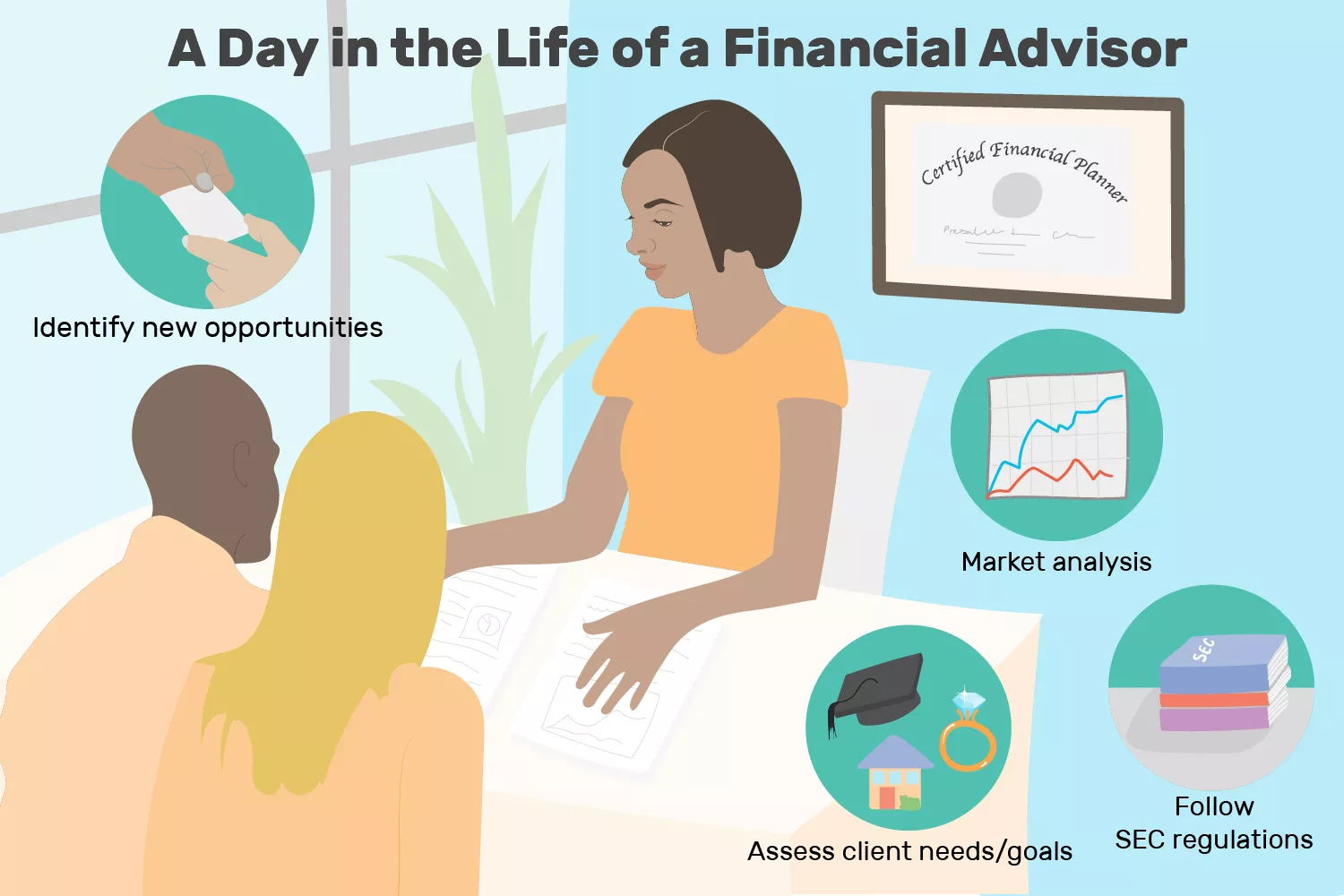

VII. Day in the Life series

This feature offers a glimpse into different careers by showing what a typical workday is like for professionals in various fields. This can be a great way to explore different career paths and see if a job aligns with your interests and expectations.

VIII. Work Rights feature (for international students)

The Work Rights feature can be very helpful if you are an international student or someone with specific work visa restrictions. Prosple customises job recommendations to only show opportunities that match your work authorisation. This saves you the hassle of filtering through irrelevant postings and ensures you focus on jobs you are legally eligible for.

Conclusion

As we just saw, there is no shortage of finance degree jobs. So, it is not a dead-end degree with just one or 2 options. This sector is full of entry-level opportunities. Don't be discouraged if you are unsure of the right fit yet. Look at the options we discussed and find the one that excites you. Go out there and make it yours.

Prosple is a powerful job search platform designed to connect recent graduates with exciting finance jobs and internships. With a massive database of opportunities and a free application process, we can help you get a job at the best companies in the financial sector.

Register now and start browsing Prosple to discover the perfect finance career path for you.