21 Must-Have Accounting Skills For Entry-Level Roles

Amina Ibrahim

The job market for accountants is competitive, but ruthless efficiency wins. So you can’t afford to waste time on fluff; you must focus on essential accounting skills. But the question here is how do you know which skills are the most important?

That is exactly what we will answer in this article. We will give you 21 hard and soft skills to make it big in Australia’s accounting job market.

11 most important soft skills for starting a career in accounting in Australia

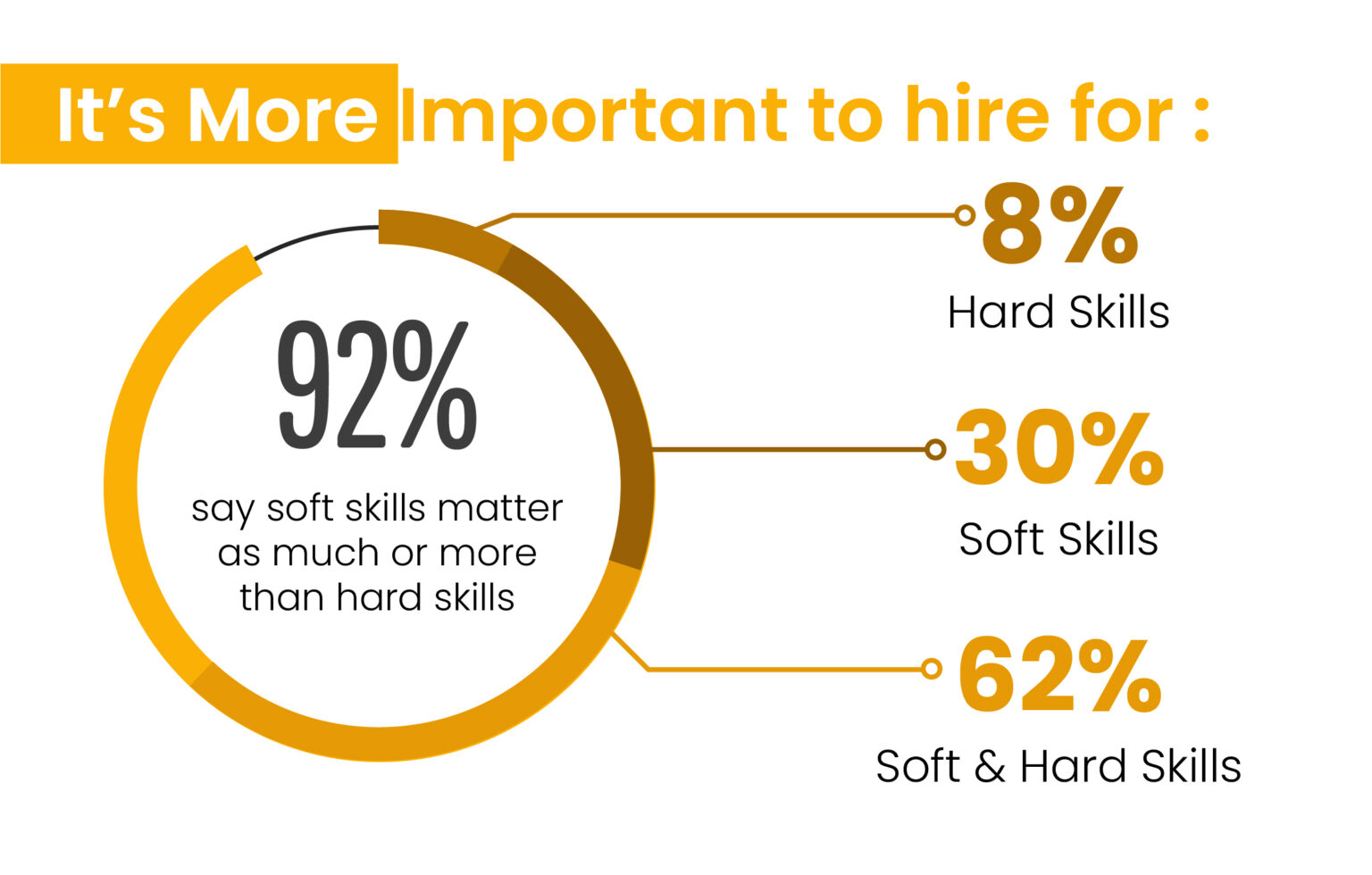

92% of hiring experts believe soft skills are just as important, if not more so, than hard skills. So to get ahead in accounting, focus on developing these 11 essential soft skills.

1. Attention to detail

Accounting is all about accuracy. One misplaced number can have a ripple effect throughout financial statements. So you need to develop a hawk-eye for detail. Here's how:

- Double and triple-check your work. Get in the habit of reviewing your entries and calculations 2-3 times before finalising anything.

- Be on the lookout for anything that seems off. A slight variance in an invoice or an unexpected jump in an expense category could mean a potential issue.

- Don't be afraid to ask for clarification if something is unclear. It is better to double-check upfront than to assume and make mistakes.

- Create a proofing system or checklist to cover all the bases before submitting your work. This could be verifying source documents, cross-referencing numbers, and double-checking for typos.

- Use accounting software's built-in verification tools. They can highlight inconsistencies and potential errors and save you some valuable time.

2. Communication skills

Numbers are your specialty but don't underestimate the power of clear communication. As an accountant, you will explain complex financial concepts to colleagues, managers, and clients. Here's how to polish your communication skills:

- Your reports should be easy to understand, even for someone without an accounting background. Use clear and concise language and avoid technical terms whenever possible.

- Whether it is in a meeting or a written report, explain your findings in a way that is clear, organised, and to the point. Focus on the key takeaways and avoid overwhelming your audience with technical details.

- Pay close attention to what others say and ask clarifying questions if needed.

- Consider if you are presenting to senior management or a new intern. Adjust your communication style to suit the listener's understanding level.

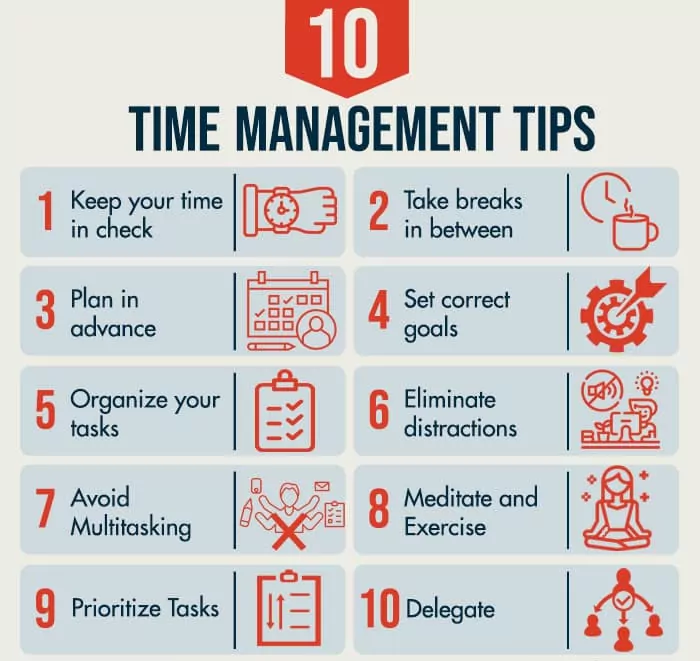

3. Time management

Accounting can be fast-paced, especially during busy seasons like tax filing. You will be handling multiple projects with different deadlines. With strong time management skills, you can meet those deadlines and avoid last-minute scrambles. Here's how to get started:

- List all your tasks for the day or week, and rank them based on importance and urgency. Tackle the high-priority tasks first, and delegate or reschedule less critical ones.

- Block out specific times for different tasks in your calendar. Be realistic about how much you can do in a given timeframe.

- Learn to say no. It is okay to decline to take on additional work if your plate is full. Protect your time to make sure you can deliver high-quality work on existing projects.

4. Problem-solving

Challenges are inevitable in any accounting role. There will be times when you face discrepancies, errors, or unexpected situations and it is your job to track them down. A strong problem-solver can analyse financial data, identify inconsistencies, and develop solutions to ensure the company’s financial health isn't compromised.

Here's how to strengthen your problem-solving skills:

- Don't get overwhelmed. Start by dissecting the issue into smaller, more manageable parts. This will help you identify the root cause.

- Research and collect all relevant data. Talk to colleagues, review records, and use your knowledge of accounting principles to gather clues.

- Brainstorm all possible solutions. Don't settle for the first idea that comes to mind. The more options you consider, the better chance of finding the most effective solution.

- Analyse each solution carefully. Consider its impact on the company’s financial health and potential risks.

5. Teamwork

Accounting isn't a one-man show. You will work with various teams in a company, from sales and marketing to human resources. As a team player, you can learn from experienced accounting professionals and share ideas for accurate and timely financial reporting. Here's how to develop strong teamwork skills:

- Keep everyone informed about your progress and the challenges you face.

- If you see a teammate struggling, lend a hand. Collaboration goes both ways and helping others will build strong relationships within the team.

- Don't be afraid of constructive criticism. Use it to learn and grow as a professional.

- Every team member has unique skills and experiences. Value their input and be open to learning from others.

- Celebrate successes together and acknowledge the team's accomplishments.

6. Adaptability

Accounting is constantly evolving. Imagine new regulations or a client switching to a different accounting software. As an accountant, you need to adapt to these changes quickly. Here's how to stay adaptable:

- Be curious and learn new skills to stay updated on industry trends. Take online courses, attend workshops, and read industry publications.

- Step outside your comfort zone and try new approaches. Be willing to learn from your mistakes and adjust your methods as needed.

- Accounting software is constantly being upgraded. Learn new programs and be comfortable adapting your workflow to stay efficient.

- Master online research tools and become familiar with relevant accounting resources. If you know how to find reliable information quickly, you can handle change better.

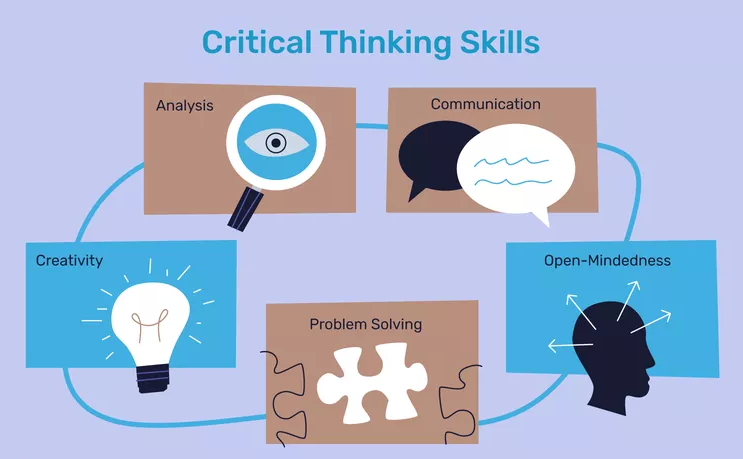

7. Critical thinking

Critical thinking lets you see beyond the surface. You analyse the data, identify inconsistencies, and question assumptions. This is important because sometimes things aren't what they seem. Errors can hide, fraud can occur, and business decisions rely on strong financial analysis. Here's how to strengthen your critical thinking:

- Don't just accept information at face value. Ask "why" and "how." Get curious about the details behind the numbers.

- Look at a situation from different angles. What might be missing from the initial picture?

- Think ahead and practice "What If" scenarios. How could changes in the market or regulations impact the financial statements?

- Analyse case studies of accounting problems and see how professionals approached them.

- Engage in discussions with classmates or professors. Bounce ideas off each other and learn from different viewpoints.

- Play devil's advocate and consider the opposite viewpoint. This can show potential weaknesses or flaws in a process or financial statement.

8. Organisational skills

Accounting tasks have strict deadlines. With strong organisation, you can stay on top of your workload and prioritise tasks effectively. Plus, good organisation keeps everything in its place, making it easier to find information and minimise mistakes. Here are ways to become organised:

- A physical and digital mess can cloud your thinking. Keep your workspace clean and categorise your digital files logically.

- Dedicate specific times in your day or week to organise your files, emails, and workspace.

- Clearly define deadlines and expectations with colleagues and clients. This ensures everyone's on the same page and avoids confusion.

- Develop templates for commonly used documents like invoices, reports, and checklists. This saves time and ensures consistency.

9. Ethical judgement

The foundation of any accounting career is trust. Investors, creditors, and management – all rely on accountants for accurate and unbiased financial information. There will be situations where pressure exists to manipulate numbers or bend the rules.

Ethical judgment ensures you make decisions that are honest and follow all relevant accounting standards, which will definitely boost your reputation in the long run.

Here’s how to develop strong ethical judgment:

- Familiarise yourself with the ethical guidelines established by your local accounting body.

- Be aware of situations where there might be a conflict of interest or pressure to compromise standards.

- If you are unsure about a situation, don't hesitate to get advice from a senior colleague or mentor.

- Maintain clear and detailed records of your work. This protects you and promotes transparency.

- If you see something unethical happening, report it through the proper channels.

- Consider the consequences of your actions. Don't make decisions based on short-term gains that could damage your reputation or the profession's credibility.

10. Initiative

As a new accountant, you might think it is all about following instructions perfectly. But there's another side to the coin – taking initiative. This doesn't mean going rogue, but rather showing a willingness to go above and beyond the basic tasks. It shows you are a go-getter who doesn't wait to be told what to do.

Here’s how to do it the right way:

- Be observant and identify areas where you can add value. Look for repetitive tasks or bottlenecks in workflows.

- Before suggesting changes, research best practices and potential solutions.

- Don't just throw out ideas and walk away. Be willing to help implement your suggestions and see them through.

- Don't wait for tasks to be assigned. Ask about any ongoing projects where you can lend a hand or volunteer for new initiatives.

- If you make a mistake, take ownership and propose solutions to fix it.

11. Stress management

Deadlines, data overload, and complex calculations - accounting can get stressful. Strong stress management skills keep you calm and clear-headed and minimise errors in your work. Plus, you will feel better overall and be more productive at work. Here are ways to manage stress effectively:

- Step away from your desk regularly for short walks, stretches, or deep breathing exercises. This helps clear your head and lets you return to your work feeling refreshed.

- Maintain a healthy lifestyle. Eat nutritious foods, get enough sleep, and exercise regularly for better stress management.

- Practice relaxation techniques. Deep breathing exercises, meditation, or mindfulness practices can help you manage stress in the moment.

10 technical accounting skills for entry-level success in Australia

Beyond the basic accounting skills, you need advanced technical skills to truly stand out and succeed. Check out these 10 essential skills you need to advance in an accounting job, and pay special attention to strategies so you can develop and refine these skills effectively.

12. Financial reporting (Basic)

It takes the raw financial data you work with and transforms it into clear, concise reports that paint a picture of a company's financial health. Errors in financial reports can mislead people and damage the company's reputation. Strong financial reporting skills make you a valuable asset because you can ensure the company's financial story is accurate and transparent.

Here's how you can improve your financial reporting skills:

- Familiarise yourself with Generally Accepted Accounting Principles (GAAP), equivalent to International Financial Reporting Standards (IFRS). Use them to create compliant reports that avoid legal issues.

- Don't just memorise formats – understand the reasons behind each line item in financial statements. Ask your professor questions and discuss real-world examples.

- Xero or MYOB offer opportunities to create practice financial statements. Take advantage of these and analyse reports from real companies.

- Often, non-profits need help with financial reporting. Volunteering can give you hands-on experience creating basic financial statements.

- Stay updated on current accounting pronouncements and how they affect financial reporting. Reading industry publications is a great way to do this.

- You can find online courses that teach financial reporting analysis. Enroll in one to improve your knowledge and understanding.

13. General ledger maintenance

The general ledger is the single source of truth for a company's financial data. Errors here can have a domino effect and negatively impact all your financial reports. Understand how the general ledger works to keep strong internal controls and avoid fraud or errors.

Here’s how you can solidify your general ledger skills:

- Understand the accounting cycle. Learn the steps for processing transactions, from recording them initially to posting them to the general ledger.

- Understand how accounts are categorised and how they relate to each other. Many accounting software programs offer pre-built charts of accounts, but you should understand the logic behind them.

- Learn common internal controls for cash handling, accounts payable, and accounts receivable.

- Learn how to reconcile bank statements, credit card statements, and other financial accounts. Practice makes perfect, so volunteer to help with reconciliations during internships or volunteer work.

- If possible, observe how experienced accountants maintain the general ledger. Ask questions about their process and learn from their best practices.

14. Accounts payable/receivable

A company's cash flow is its foundation. Unpaid invoices can damage supplier relationships and uncollected receivables can cause bad debts. You should know how to efficiently manage accounts payable and receivable to ensure the company has enough cash to pay its bills and operate smoothly.

Here's how you can strengthen your AP/AR skills:

- Understand the entire purchase-to-pay (AP) and sales-to-cash (AR) cycles. Know the different stages involved, from issuing purchase orders to receiving payments for invoices.

- Internal controls are just as important for AP/AR as they are for the general ledger. Learn about best practices for managing vendor payments and customer collections.

- Most companies use accounting software to manage AP and AR. Get comfortable with the AP and AR modules of popular accounting programs.

- There are many technological solutions available to streamline AP and AR processes. Explore options like electronic invoicing and automated payment processing.

- Develop a good understanding of the company's payment terms and credit policies. This helps you anticipate cash flow needs.

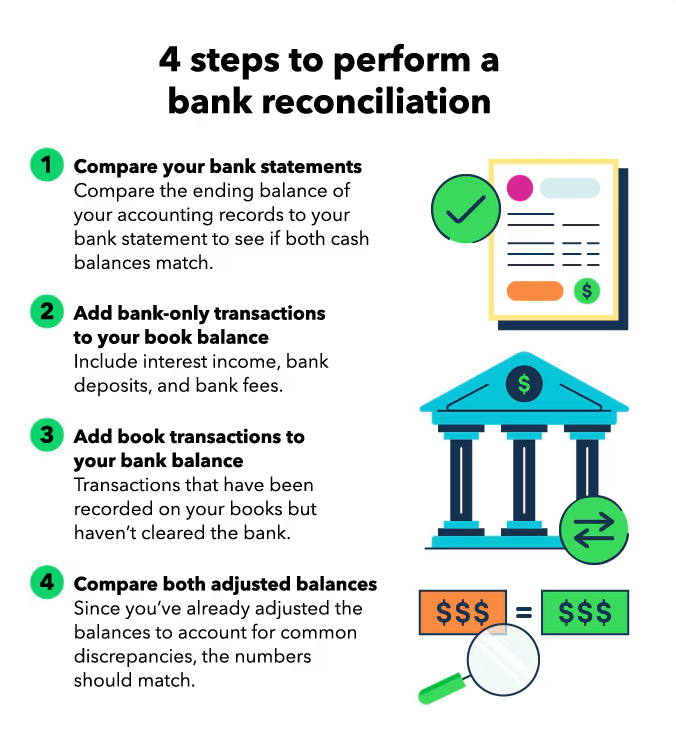

15. Bank reconciliation

Bank statements can have errors or missed transactions. You have to regularly reconcile them to identify these differences and keep your books accurate. Also, unidentified discrepancies can be signs of fraud. When you know how to reconcile bank statements, you can maintain a healthy level of scepticism and potentially uncover suspicious activity.

- Break down the bank reconciliation process step-by-step. Learn how to identify outstanding checks, deposits in transit, and bank fees.

- Even small errors in bank reconciliations can have big consequences. Double-check your calculations and entries.

- Discrepancies found during reconciliations might require further investigation. Learn how to communicate effectively with bank personnel and colleagues in accounts payable or receivable to resolve any outstanding issues.

- Accounting software programs offer features to automate bank reconciliations. Familiarise yourself with these tools and how they can streamline the process while minimising errors.

- Bank reconciliations should be performed regularly, typically monthly. Develop a consistent routine and stick to it.

16. Payroll processing

Payroll taxes and deductions are complex and constantly changing. Understand these rules so that the company complies with regulations and avoids penalties. Plus, strong payroll processing skills help ensure employees get paid on time and accurately. Here’s how you can sharpen your payroll processing skills:

- Familiarise yourself with Australian payroll tax regulations and employee entitlements. Focus on payroll taxes like PAYG and superannuation. Resources like the Australian Taxation Office (ATO) can be very helpful.

- Get comfortable with popular payroll programs like MYOB Payroll or Xero Payroll. Many software providers offer free trials or online tutorials.

- Payroll mistakes can have serious consequences for employees and the company. Develop a meticulous approach to make sure all calculations and deductions are accurate.

- Payroll data is highly sensitive. Learn about best practices for data security and privacy to protect employee information.

17. Budgeting & forecasting

Budgets and forecasts help management make informed decisions about resource allocation, staffing, and future investments. You need these skills to compare actual results to what was planned. This way, you can identify areas where the company is exceeding or falling short of expectations.

Here’s how to do it the right way:

- Budgeting and forecasting rely heavily on financial statements like income statements, cash flow statements, and balance sheets. Be comfortable analysing these statements to identify trends and predict future financial performance.

- Learn financial modelling for building spreadsheets that forecast future financial performance. You can join Coursera and Udemy and enrol in online courses on financial modelling.

- Don't just create one budget or forecast. Develop different scenarios based on various economic conditions or market fluctuations.

- Stay informed about industry trends and economic conditions. This will help you make realistic assumptions when creating budgets and forecasts.

18. Tax preparation & compliance

Taxes are a fact of life and for businesses, they can be complex. You should know the tax laws to help companies identify deductions and credits they might be missing. This helps lower tax bills. Also, tax mistakes can mean hefty fines and penalties for the company. With your strong tax skills, you can comply with them and avoid these issues.

Here’s how you can improve your skills:

- Australia has a complex tax system. While you don't need to memorise every detail, understand relevant taxes like income tax, GST, and fringe benefits tax. Enrol in online courses or workshops the Australian Taxation Office (ATO) offers.

- Most accounting firms use specialised tax software like H&R Block Tax Professional or MYOB Tax. Look for free trials or online tutorials to get comfortable with these programs.

- Tax laws and regulations change frequently. Stay informed by subscribing to ATO Attend workshops or seminars professional accounting bodies like CPA Australia or CA ANZ offer.

- An accounting degree is a good start but consider pursuing a tax agent registration. It lets you provide formal tax advice and prepare returns for a wider range of clients.

19. Accounting software proficiency

Most accounting departments rely heavily on accounting software to manage financial data. So they expect entry-level accountants to be familiar with popular accounting software packages. Here’s how you can get it right:

- Research the most widely used accounting software programs in Australia. Popular options include MYOB, Xero, QuickBooks, and Reckon Elite.

- Many accounting software providers offer free trials and online tutorials. Use them to learn the functionalities and features of different programs.

- Look for volunteer or internship opportunities where you can get practical experience with accounting software. This will help you build your skills and show your proficiency to potential employers.

- Some accounting software providers offer certifications for their programs. Earn these certifications to show your expertise and become a more competitive candidate.

20. Cost accounting

Cost accounting goes beyond basic bookkeeping. It helps you understand the costs of producing goods or services. With it, you can identify areas where the company can reduce expenses and improve profitability. This lets management make informed decisions about pricing, product development, and resource allocation.

Here’s how you can improve these skills.

- Understand the different cost accounting methods, like cost allocation, activity-based costing, and marginal costing.

- Cost accounting is heavily linked to inventory management. Learn about different inventory costing methods (FIFO, LIFO, etc.) and their impact on cost calculations.

- Variance analysis compares actual costs to budgeted costs and identifies any discrepancies. Understand how you can perform variance analysis. Look for online resources or textbooks that explain this process in detail.

- Practice applying your cost accounting knowledge by working on case studies or simulations.

21. Financial statement preparation

Preparing financial statements lets you see the entire financial cycle – from revenues and expenses to assets and liabilities. Investors, creditors, and regulators all use the statements. Errors here can have serious consequences for the company and your reputation. Here’s how you can polish these skills:

- Make sure you have a deep understanding of accounting principles like accrual accounting, matching principles, and going concern.

- Look for opportunities to practice preparing financial statements. Volunteer with non-profit organisations or participate in accounting case studies.

- Most accounting software packages can automate the process of generating financial statements. Learn how to use these features effectively.

- Annual reports of publicly traded companies can be a goldmine of learning. Analyse their financial statements and see how they present different financial metrics.

Find Your Perfect Job Faster With Prosple

Prosple is a one-stop shop for everything related to finding your first graduate job or internship. Australia’s top employers post on our platform. You can browse opportunities, apply for them, and access career resources – all on a single platform. Here's the breakdown of what we offer:

- We designed the platform to be user-friendly so you can find your way around and find the features you need quickly. This saves you time and lets you focus on searching for jobs.

- Prosple offers advanced search filters that let you target your job search based on specific criteria. This could be things like location, industry, company size, or even job type (full-time, internship).

- Prosple uses an AI (Artificial Intelligence) matching system to connect you with jobs that are a good fit for your skills and interests. This helps uncover opportunities you might have missed otherwise.

- Not sure how to manage your resume or prepare for an interview? We at Prosple offer resources with expert career guidance, like resume writing tips, cover letter tips, and even interview questions to help you prepare for landing your dream job.

- Prosple's Day in the Life Series gives you a glimpse into different careers. This can be a great way to explore different options and see if a specific career path is the right fit for you.

- Prosple's Work Rights feature is a very helpful tool, especially for international students. It takes your work authorisation into account and customises job recommendations to only show you opportunities you are legally eligible for. This saves you the frustration of applying for jobs you can't get and helps you focus your energy on the right opportunities.

Conclusion

We listed all the accounting skills you need to become an undeniable asset to any company. But your success depends on how well you learn and apply these skills. These are not just to get you your first job. When you develop these skills early in your career, they will help you throughout. So the choice is yours: blend in or stand out.

Now is the time to take action. Prosple connects you with top employers looking for talented accounting professionals. Search for accounting internships and graduate roles, get career advice, and stand out from the competition with our resources. Join Prosple today and see how we can help you get ahead.